Calculate Upwork Revenue and Fees

Contents

From an accounting perspective, your total Upwork billings should be counted as revenue in your bookkeeping system and your total Upwork fees should be counted as expenses.

While it won’t matter from a tax perspective, doing so makes your reports consistent. For example, if you have non-Upwork clients that you invoice via PayPal, the total amount invoiced is revenue and the PayPal fees are expenses. Upwork billings and fees should be treated the same way.

However, Upwork doesn’t provide freelancers much in the way of reports or integrations to make it easy to log billings and fees separately in your bookkeeping system. Because of this, I used to just count the net amount Upwork transferred to my bank account for each withdrawal as “Other Income”, without separating the total billings and fees.

But it turns out there’s a way to separate billings and fees for each withdrawal that’s pretty easy and straightforward using Upwork’s Transaction History report and my handy-dandy spreadsheet. Here’s how to do it.

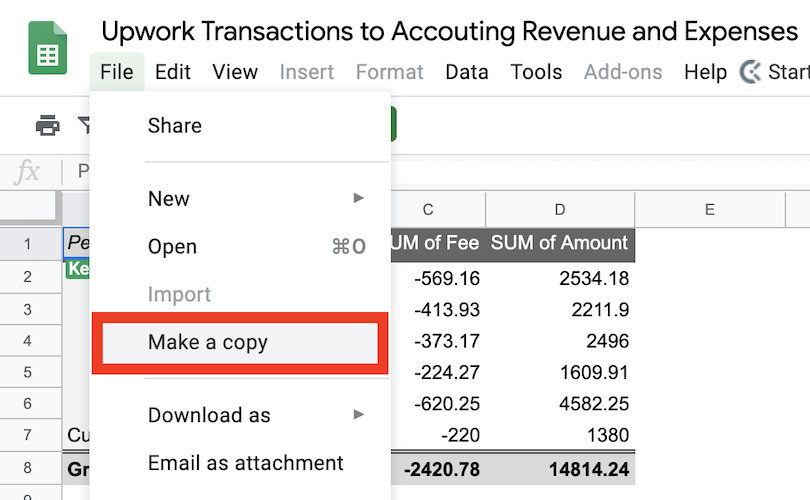

First, copy the handy-dandy Google Sheet to your Google Drive.

Download Upwork Transaction History

Next, download your Transaction History report from Upwork like so:

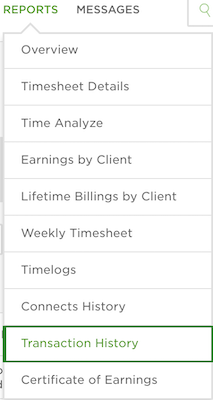

On your Upwork profile go to **Reports > Transaction History**.

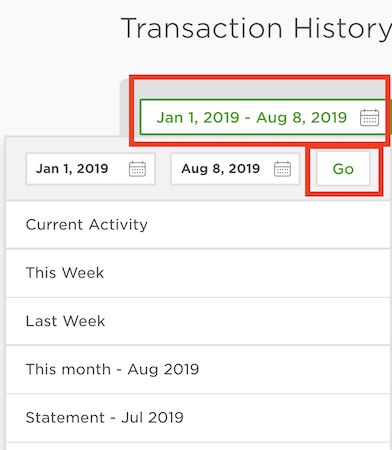

Set your desired start and end dates and click Go.

Download the CSV.

Calculate Total Billings and Fees

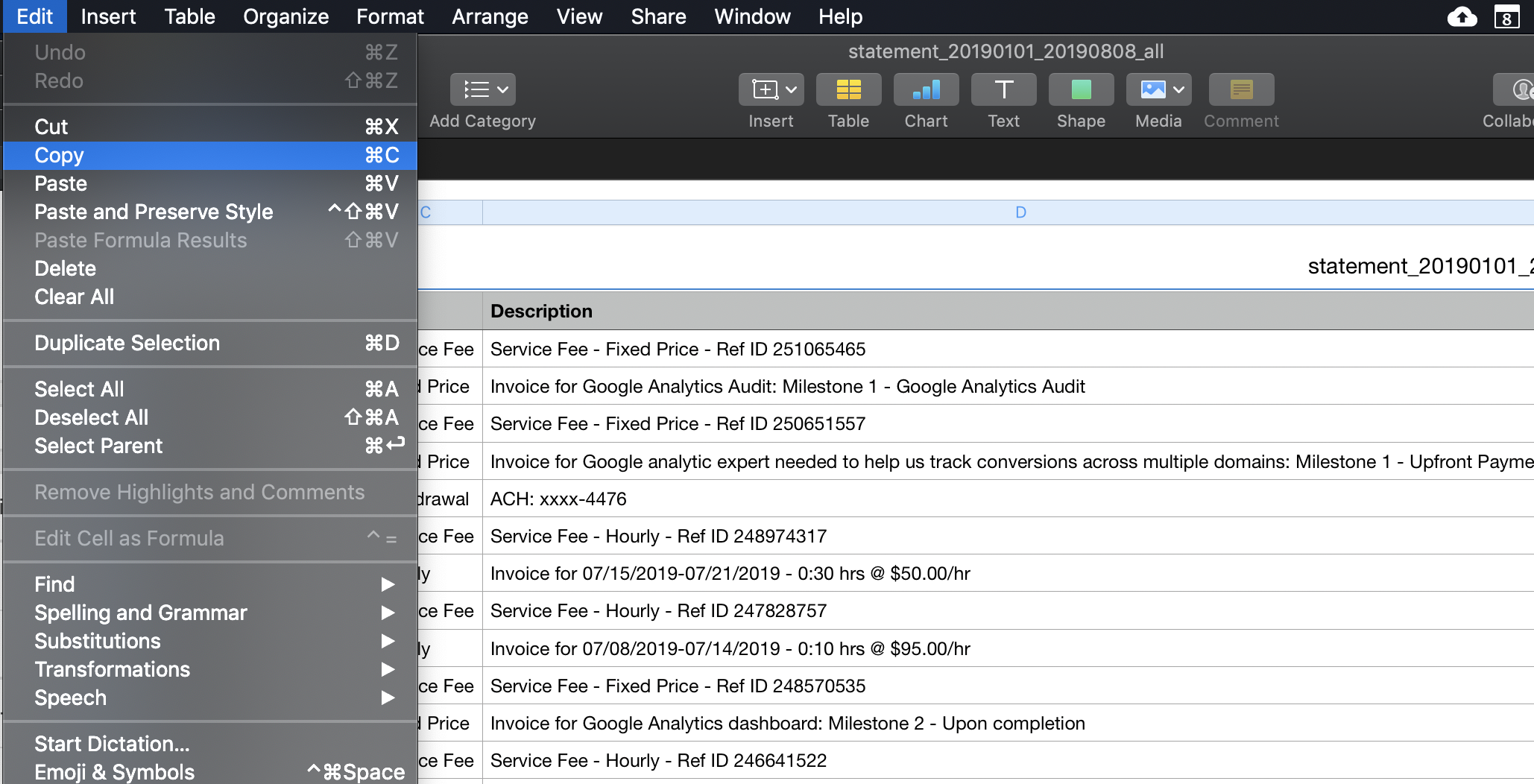

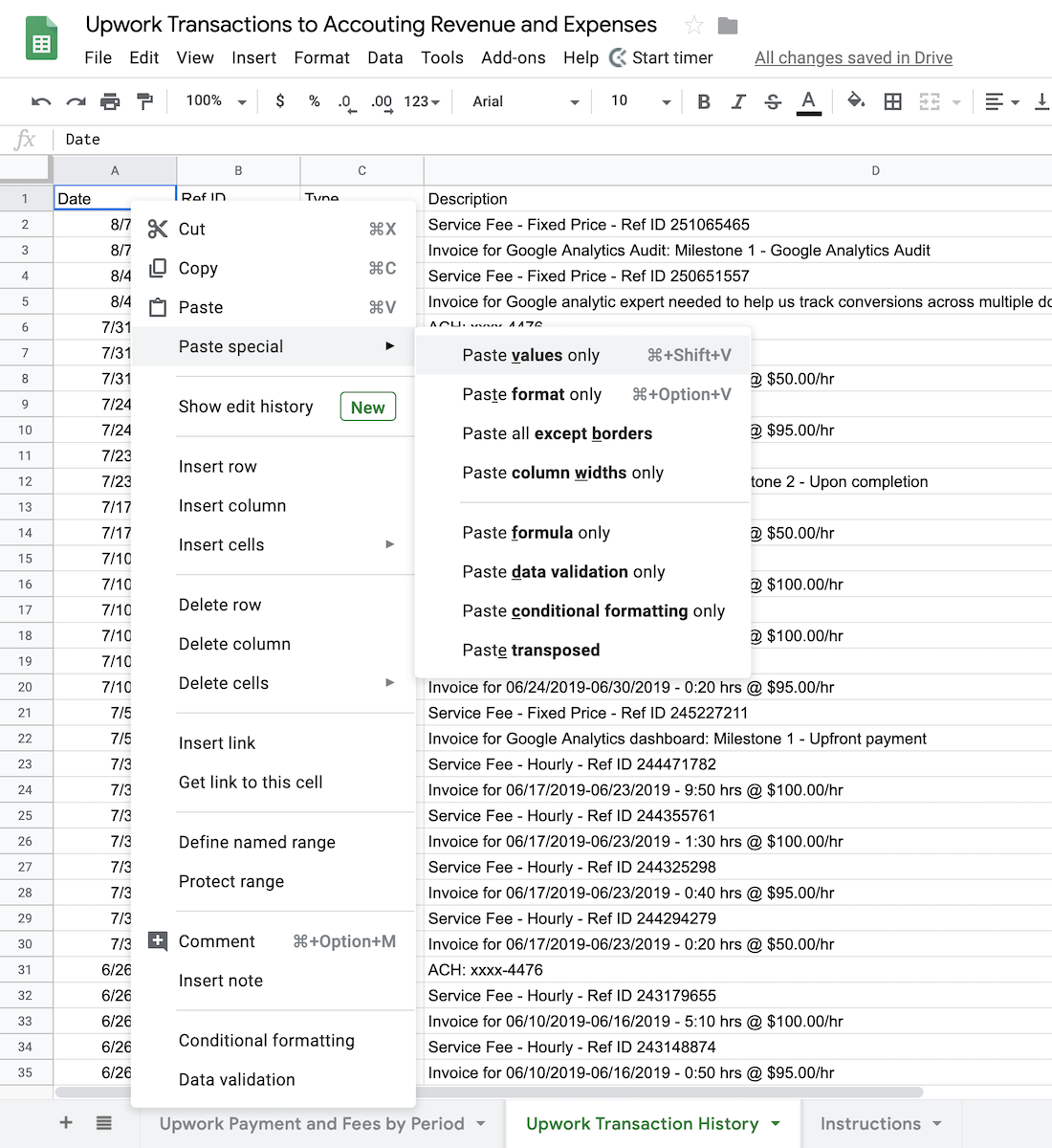

Now, copy all the transactions from the CSV (including the column headers),

And paste them into the Google Sheet by clicking cell** **A1 of the *Upwork Transaction History* sheet, right clicking, and selecting Paste special > Paste values only.

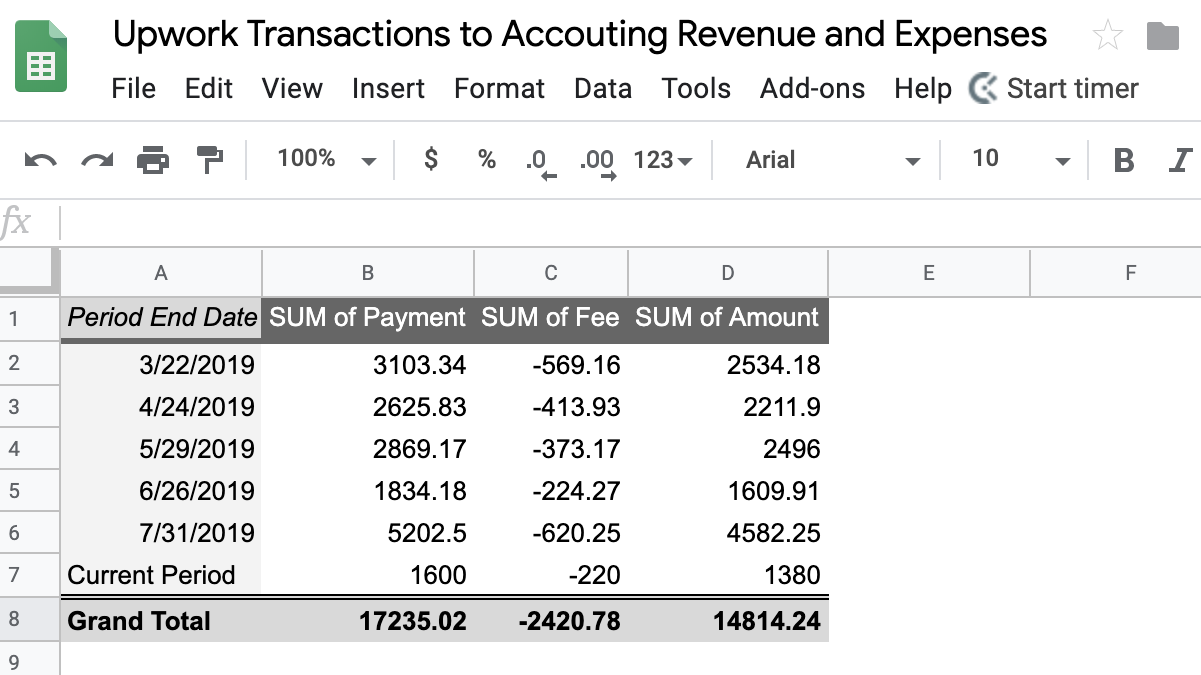

Now that you’ve updated the Google Sheet with your Upwork transactions, just look at the Upwork Payment and Fees by Period to see the results.

The Period End Date column is the date that you withdrew that money from Upwork. Everytime you withdraw money a new “period” starts.

The SUM of Payment column is the total revenue for each withdrawal.

The SUM of Fee column is the total fees for each withdrawal.

And the SUM of Amount column is the net profit for each withdrawal. This should match the amount Upwork actually transferred to your bank account.

Add Total Billings and Fees to Bookkeeping

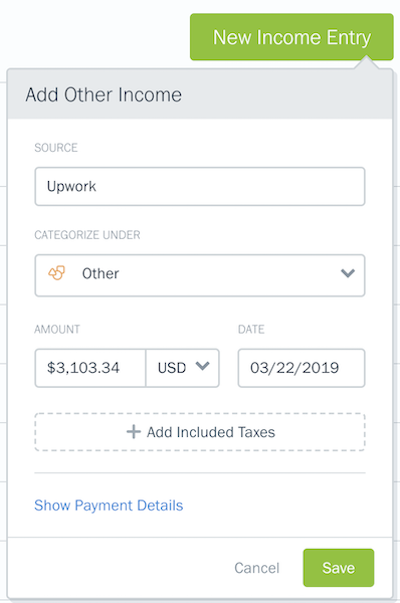

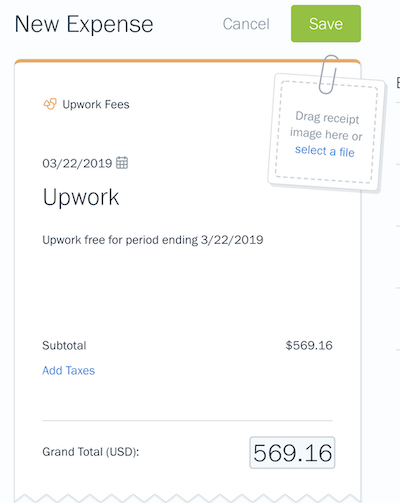

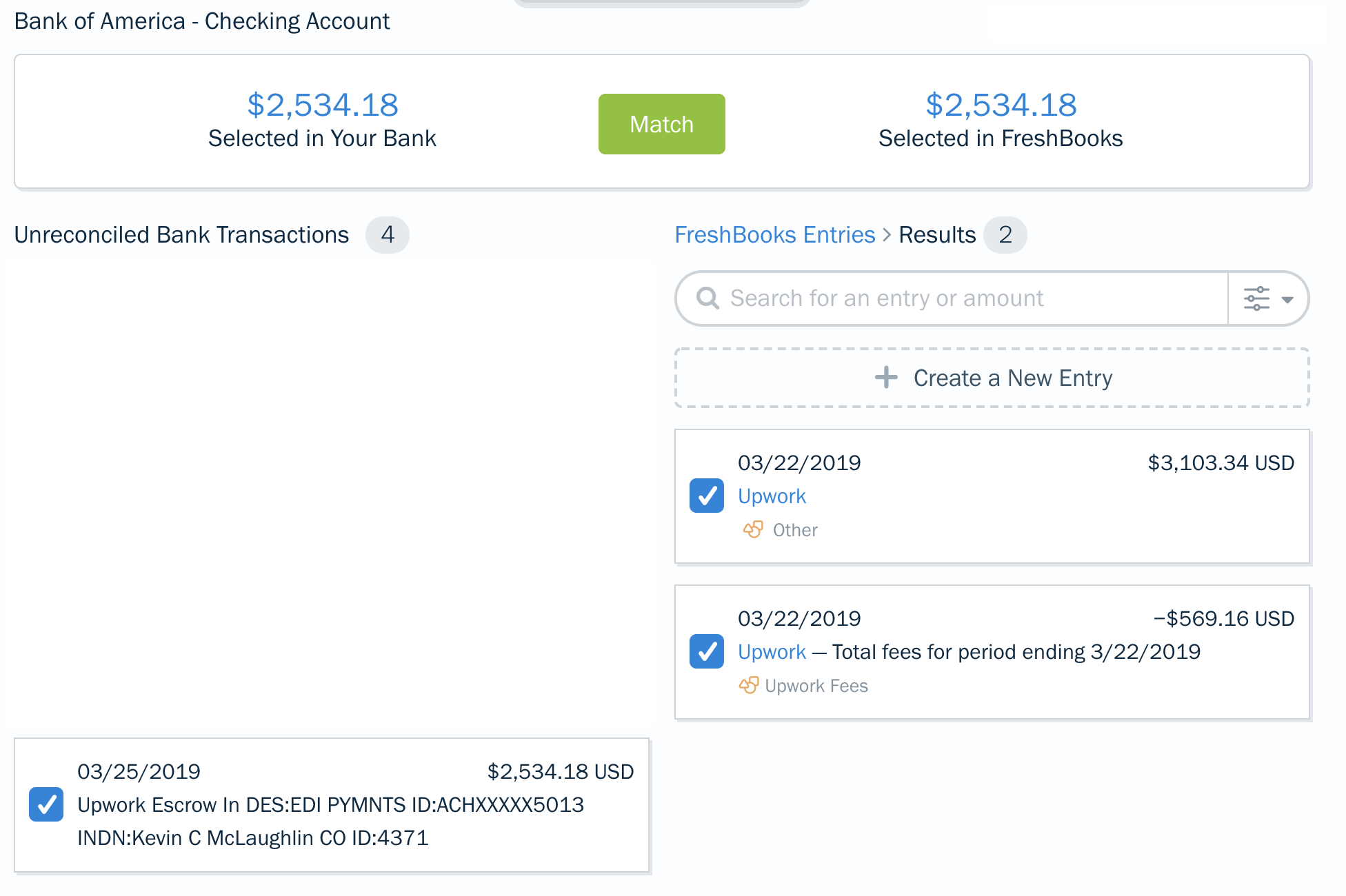

With this report, tracking Upwork revenue and fees in your accounting system is easy. I use Freshbooks so I do the following:

Create an Other Income equal to the SUM of Payment for each withdrawal,

and an Expense equal to the SUM of Fee for each withdrawal.

With the total revenue and fees properly recorded in your books, you can match these with the Upwork deposit that actually hit your bank account for double bookkeeping.

If you report Upwork revenue and fees this way, it’ll keep Upwork payments consistent with your other billing methods and show you how much money Upwork is making off of you.

Socratic Owl

Socratic Owl